charlenekja21

I Need a Loan With No Credit Check: Understanding Your Options

In at present’s financial panorama, many people find themselves in need of fast money but are held again by their credit score scores. Whether as a consequence of previous monetary errors, a scarcity of credit history, or unexpected bills, the search for a loan without a credit check has turn into more and more frequent. This report aims to discover the varied choices obtainable for acquiring a loan without undergoing a credit score check, the potential dangers concerned, and important issues for borrowers.

Understanding No Credit Check Loans

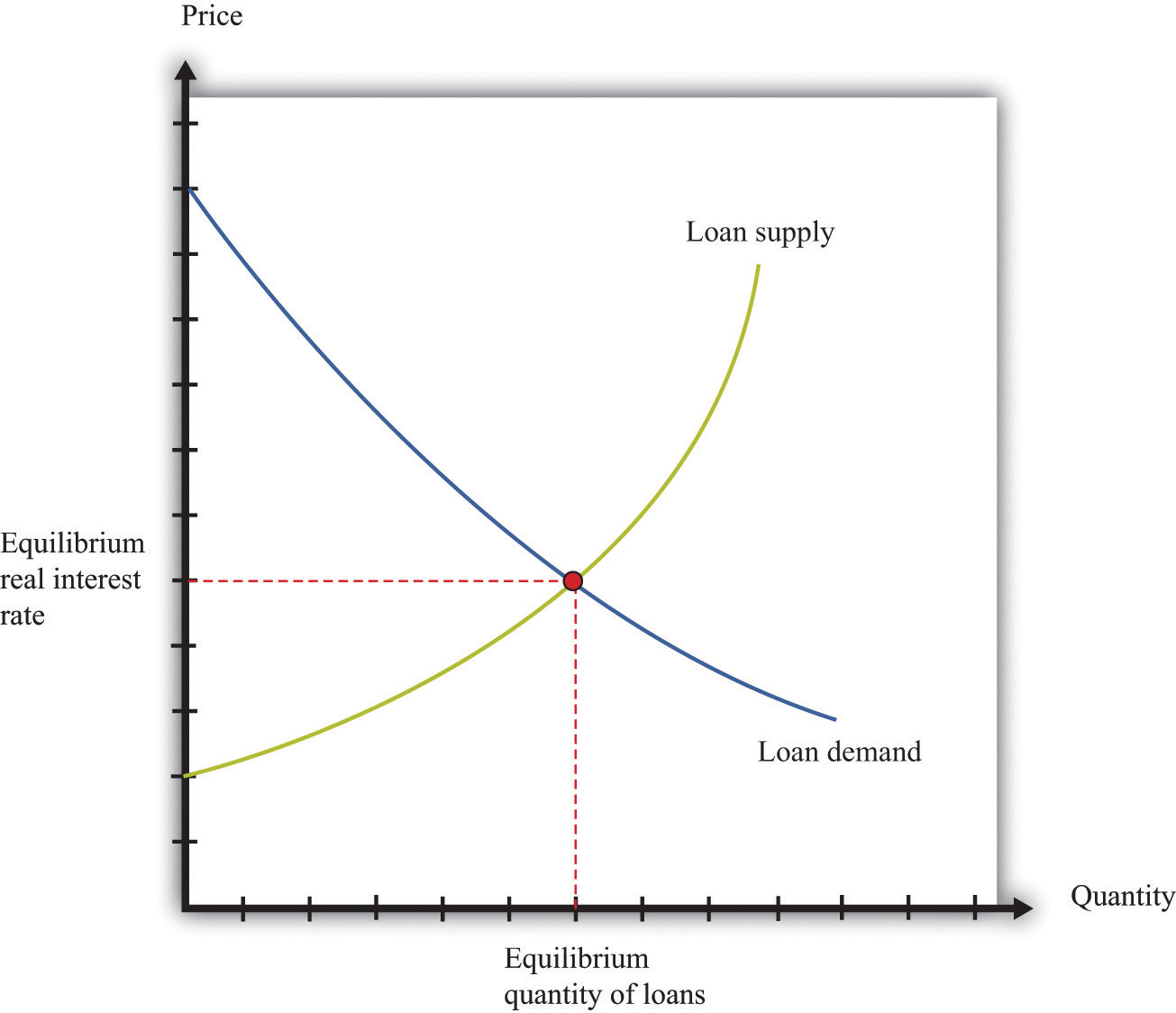

No credit check loans are monetary merchandise designed for people who could not qualify for traditional loans as a result of poor credit scores or insufficient credit score historical past. These loans typically don’t require lenders to evaluate the applicant’s credit score report, making them accessible to a broader vary of borrowers. Nonetheless, this ease of entry usually comes with greater interest charges and charges, as lenders mitigate their risk by charging extra for these loans.

Sorts of No Credit Check Loans

- Payday Loans:

Payday loans are quick-term loans that present money advances based on the borrower’s next paycheck. They are typically small quantities, ranging from $one hundred to $1,000, and are expected to be repaid inside a number of weeks. While payday loans do not normally require a credit score check, they include extremely excessive-curiosity charges, making them a dangerous option for many borrowers.

- Title Loans:

Title loans permit borrowers to make use of their automobile’s title as collateral. The loan quantity is often based on the car’s worth. While lenders might not check credit score scores, they will assess the automotive’s situation and ownership. If the borrower fails to repay the loan, the lender can repossess the automobile.

- Installment Loans:

Some lenders offer installment loans with no credit check, allowing borrowers to repay the loan in fixed monthly payments over a set period. These loans could have more favorable terms than payday loans however can nonetheless carry excessive-curiosity charges.

- Peer-to-Peer Lending:

Peer-to-peer (P2P) lending platforms connect borrowers with particular person investors keen to fund their loans. Whereas some P2P platforms may perform credit checks, others may allow borrowers to current their case with no credit score historical past. This feature can provide more versatile phrases and lower curiosity rates compared to conventional lenders.

- Cash Advances:

If in case you have a bank card, you could possibly take out a money advance with out a credit score check. If you beloved this post and you would like to acquire far more data pertaining to same day small loans no credit check – bestnocreditcheckloans.com – kindly take a look at our web site. However, money advances typically include excessive fees and interest rates, and the amount you’ll be able to borrow is proscribed to your available credit score.

The Dangers of No Credit Check Loans

While no credit check loans may seem interesting, they include significant risks that borrowers ought to consider:

- Excessive-Interest Charges: Many no credit check loans have exorbitant interest charges, which may result in a cycle of debt if borrowers are unable to repay the loan on time.

- Hidden Charges: In addition to excessive-interest rates, these loans often include hidden charges that may increase the entire cost of borrowing significantly.

- Brief Repayment Phrases: Many no credit check loans require repayment inside a short interval, which might be difficult for borrowers who are already in monetary distress.

- Risk of Repossession: For secured loans like title loans, failing to repay the loan can outcome in the loss of valuable assets, such as a car.

- Potential for Predatory Lending: Some lenders may take advantage of borrowers’ determined conditions by providing loans with unfavorable terms. It is essential to research lenders completely and understand the terms before committing to a loan.

Alternate options to No Credit Check Loans

Earlier than resorting to no credit check loans, borrowers should consider different options that will provide higher phrases:

- Credit score Unions: Many credit unions supply small personal loans to members, typically with extra favorable phrases and decrease interest charges than payday lenders.

- Personal Loans from Conventional Lenders: Some banks and on-line lenders supply personal loans with versatile eligibility standards. While they might carry out credit score checks, they often present options for these with decrease credit score scores.

- Borrowing from Associates or Family: If potential, consider borrowing from friends or members of the family. This option might come with decrease or no interest and extra flexible repayment phrases.

- Government Assistance Packages: Relying in your scenario, you could qualify for authorities help programs designed to help people going through financial hardship.

- Debt Management Plans: In case you are struggling with multiple debts, consider working with a credit counseling service to create a debt management plan, which will help consolidate your payments and reduce curiosity rates.

Conclusion

Whereas the allure of no credit check loans is understandable, borrowers should approach these monetary products with caution. The risks related to high-interest rates, hidden charges, and potential debt cycles can outweigh the benefits of fast access to cash. It’s crucial to explore all out there choices, together with traditional loans, credit unions, and assistance programs, earlier than making a call. By doing so, borrowers could make knowledgeable decisions that lead to raised monetary outcomes and keep away from falling right into a cycle of debt. At all times remember to learn the fine print, understand the terms, and assess your means to repay any loan before proceeding.