jimmiecastle8

Developments In IRA Gold Investment: A Comprehensive Overview

Lately, the landscape of retirement investment choices has evolved dramatically, significantly in the realm of Particular person Retirement Accounts (IRAs). One of the crucial notable advancements is the growing popularity of gold as an funding automobile within IRAs. This text explores the present state of IRA gold investment, highlighting the advancements that have made it more accessible, secure, and helpful for buyers.

Understanding IRA Gold Investment

Gold has long been viewed as a protected-haven asset, particularly during intervals of economic uncertainty. An IRA gold investment allows individuals to include bodily gold ira companies near me (Irasgold.com) and different precious metals of their retirement portfolios. This diversification might help mitigate risks associated with conventional investments like stocks and bonds, notably during market volatility.

Regulatory Changes and Increased Accessibility

One of the most vital advancements in IRA gold investment is the evolving regulatory framework that has made it simpler for investors to incorporate gold of their retirement accounts. The Taxpayer Relief Act of 1997 was a pivotal moment, as it allowed for the inclusion of certain kinds of precious metals in IRAs. Nonetheless, the regulations surrounding these investments have continued to evolve.

In the present day, custodians and administrators specializing in valuable metal IRAs have emerged, offering investors with more choices and streamlined processes. These custodians handle the compliance necessities, ensuring that the gold investments adhere to IRS regulations, which stipulate that the gold have to be saved in an approved depository and meet particular purity requirements.

Technological Improvements

The rise of expertise has also transformed IRA gold investment. On-line platforms and cell applications have made it simpler for buyers to manage their gold holdings, observe market costs, and execute transactions. Buyers can now buy, sell, or commerce gold inside their IRAs at the click of a button, making the method extra environment friendly and user-friendly.

Furthermore, developments in blockchain know-how are starting to make their mark on gold investments. Some companies are exploring the use of blockchain to create digital tokens that represent physical gold holdings. This innovation could improve transparency and safety, allowing buyers to verify their possession and the authenticity of their belongings easily.

Enhanced Safety Measures

As the demand for gold in IRAs grows, so does the necessity for enhanced security measures. Custodians are more and more adopting state-of-the-artwork security protocols to guard investors’ belongings. This consists of advanced surveillance methods, safe storage services, and insurance insurance policies that safeguard against theft or loss.

Moreover, the use of segregated storage is becoming more widespread. Which means that an investor’s gold is stored separately from different clients’ holdings, offering an added layer of security and peace of thoughts. Buyers can relaxation assured that their property are protected and simply identifiable.

Diversification and Risk Management

Considered one of the first reasons for the surge in IRA gold investments is the rising understanding of diversification and threat management. Financial advisors at the moment are more steadily recommending gold as a hedge against inflation and financial downturns. As conventional markets fluctuate, gold often retains its value, making it a lovely option for retirement portfolios.

Traders are also becoming extra educated about the advantages of including quite a lot of precious metals in their IRAs. Past gold, options comparable to silver, platinum, and palladium are gaining traction. This diversification throughout the precious metals sector permits traders to unfold their danger further and capitalize on completely different market dynamics.

Instructional Resources and Help

One other vital advancement in IRA gold investment is the availability of academic sources and support for buyers. Many custodians and financial advisors are actually offering complete guides, webinars, and one-on-one consultations to help individuals perceive the intricacies of investing in gold inside their IRAs.

This increased entry to info empowers buyers to make informed choices. They’ll higher grasp the potential risks and rewards associated with gold investments, leading to extra strategic and confident funding selections.

Competitive Charges and Providers

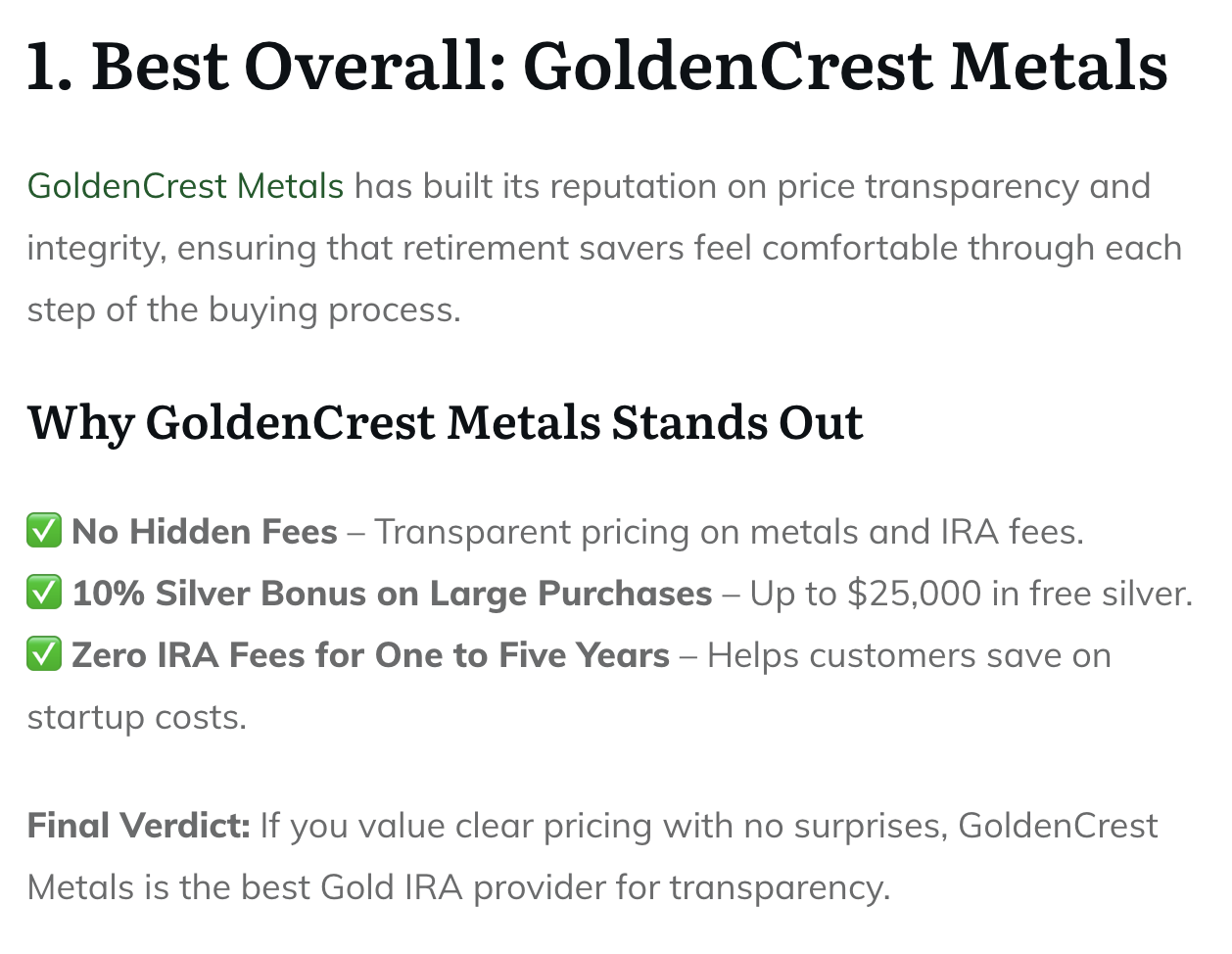

Because the market for IRA gold investments has expanded, competitors amongst custodians and repair suppliers has intensified. This competitors has resulted in more competitive fees and improved providers for traders. Many custodians now provide transparent pricing constructions, making it easier for investors to know the costs associated with their gold investments.

Additionally, some custodians provide added services, comparable to free market evaluation, common portfolio opinions, and personalised funding strategies. This stage of service enhances the general experience for traders, guaranteeing they’ve the support they should navigate the complexities of gold investments.

The Function of Financial Components

The present economic climate has additionally played a big function in the development of IRA gold investment. With rising inflation rates, geopolitical tensions, and uncertainties in the stock market, many buyers are turning to gold as a protective measure. The demand for gold in IRAs has surged as individuals search to safeguard their retirement savings towards potential financial downturns.

Moreover, central banks world wide have been growing their gold reserves, signaling a renewed confidence in the asset. This development additional bolsters the case for particular person traders to contemplate gold as a viable possibility for his or her retirement portfolios.

Conclusion

In abstract, the advancements in IRA gold investment have made it a extra accessible, secure, and enticing possibility for retirement planning. Regulatory changes, technological improvements, enhanced security measures, and elevated instructional sources have all contributed to the expansion of this investment avenue. As financial uncertainties persist, the enchantment of gold as a safe-haven asset is prone to continue, making it a useful consideration for these looking to diversify their retirement portfolios. With the precise steerage and resources, investors can navigate the world of IRA gold investment with confidence, guaranteeing a extra secure monetary future.